The global virtual assistant services market is booming. As businesses grow, they need more assistants to manage their operations and processes effectively. You would be shocked to know that the number of virtual assistants worldwide was estimated at 3.9 million in 2020 and is expected to reach 8.4 million by 2028.

You Will Learn

ToggleBest Method To Pay Your Virtual Assistant For USA-Based Business In 2024

Despite such growth, some businesses still need to learn about cost-effective methods of paying their international virtual assistants. They are constantly wasting their hard-earned money on unnecessary transaction fees and taxes.

Smooth and reliable payment processes are important for maintaining a positive working relationship with the virtual team. As more businesses in the USA opt to hire VAs, understanding the various methods to pay virtual assistants becomes essential to ensure efficiency and satisfaction on both sides.

This blog will explain four popular payment methods among businesses operating online in detail to help you choose the best one for your business needs.

Why the Right Payment Method Matters

Your Virtual Assistant is your right hand who cares about your business and works tirelessly to make everything go with the flow. You rely on your VA for most of your administrative and management tasks.

Just as you count on them to deliver quality work, your VA counts on you for timely and secure compensation. Choosing the right payment method isn’t just a financial decision; it’s about building trust, maintaining a strong relationship, and showing your VAs that their contributions are valued.

The right payment method helps your VA focus on their tasks without worrying about payment delays or complications, which ultimately leads to a more productive and harmonious working relationship.

Before choosing a payment method consider these factors such as the VA’s location, payment frequency, transaction speed, and transaction fee. We will discuss four popular payment methods that businesses use to pay their VAs worldwide.

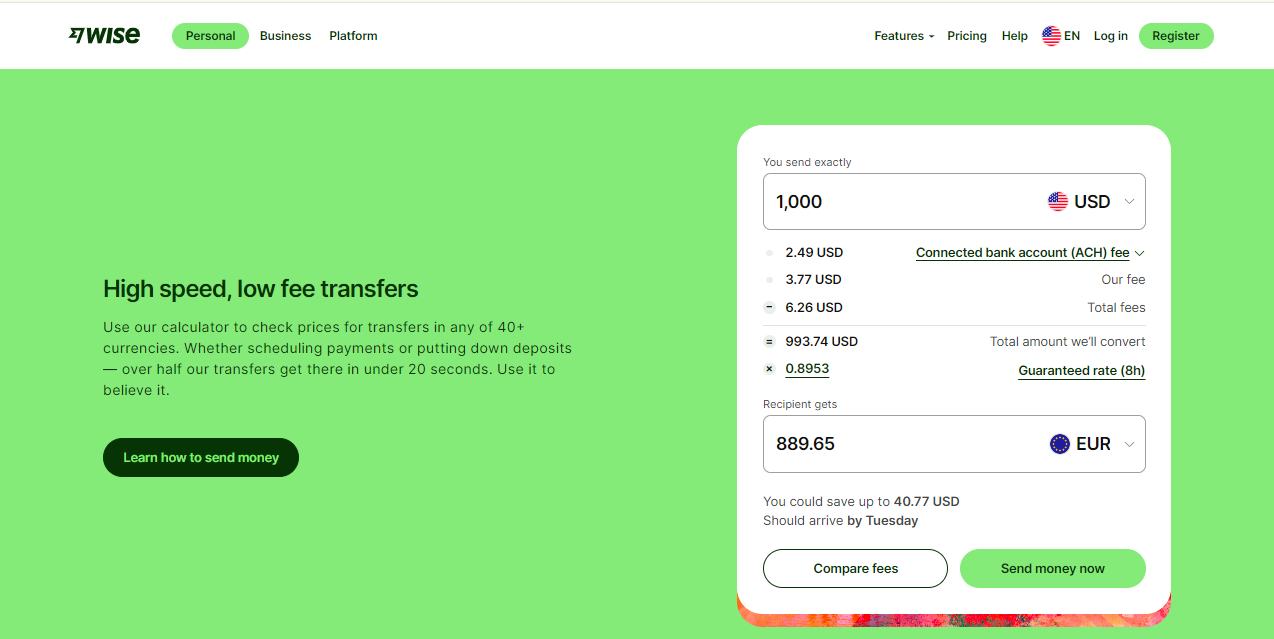

Payment Method 1: Wise

Wise is a popular payment gateway known for its efficiency in handling international transactions. Wise has around 6 million active customers right now, the company claims that they welcome 100,000 new customers every week.

Wise is renowned for its low-cost transaction fees and transparent pricing. With a decade of quality customer service, wise has expanded to such a large customer base, and the numbers are growing every day.

Paying Virtual Assistants with Wise

Key Benefits:

- Global Access: Wise provides services in 140-plus countries.

- Low Fees: Wise offers low transaction fees, making it cost-effective for both businesses and VAs. Wise has two types of fees, a fixed fee and a variable fee. The fixed fee is around 7 USD for a wire transfer on popular payment routes from the US.Whereas the variable fee covers the cost of the currency exchange and varies from 0.33% to 0.5% depending upon the country where you are sending money.For example; Wise charges a 0.4% variable fee for France, 0.39% for Australia, 0.54% for India, and 0.57% for the Philippines.Whichever payment method you pick, you’ll always see the full fee before you confirm the transaction. Let’s understand the Wise international transfer fees for a few major currencies:

| Sending 1000 USD | Fixed Fee | Variable Fee | Total Fees |

| The UK | 7.03 USD | 4.35 USD (0.44%) | 11.38 USD |

| France | 7 USD | 3.96 USD (0.4%) | 10.96 USD |

| Australia | 7.34 USD | 3.86 USD (0.39%) | 11.20 USD |

| India | 7.17 USD | 5.63 USD (0.57%) | 12.80 USD |

| Philippine | 7.43 USD | 5.7 USD (0.57%) | 13.13 USD |

- Speed: Transactions are typically fast, which is particularly beneficial for international payments.

- Exchange Rates: Wise provides competitive exchange rates, reducing the overall cost for businesses making payments in different currencies.

Use Case

Wise is ideal for businesses that frequently make international payments, allowing them to save on fees and ensure timely transactions. Visit their Pricing for more details.

Payment Method 2: Payoneer

Payoneer is another payment platform that offers low-cost fees and a quick method for international transactions. Payoneer is trusted by millions of customers worldwide because of its comparatively low fees and reliable service.

Paying Virtual Assistants with Payoneer

Key Benefits:

- Global Access: Payoneer allows you to send and receive money among 100 plus countries in the world.

- Low Transaction Fee: Payoneer charges 1% to 3% for ACH bank debits (US only) and 3.99% + $0.49 for PayPal (US only). Visit Payoneer Pricing for more.

- Multiple Currencies: Payoneer supports up to 190 countries and 70 currencies.

- Additional Services: Payoneer offers services like prepaid cards, providing added convenience for users.

Use Case

Payoneer is advantageous for businesses employing VAs from multiple countries for smooth payments across different currencies.

Payment Method 3: PayPal

PayPal is one of the most widely used payment platforms, known for its user-friendly interface.

Paying Virtual Assistants with PayPal

Key Benefits:

- User-Friendly: PayPal is easy to use and offers a wide range of payment transfer options.

- Buyer Protection: The platform offers security features that protect both parties during transactions.

- Instant Payment Transfers: PayPal allows for instant transfers, though this may incur additional fees.

Note: A notable downside of PayPal is its higher fees, especially for international payments. Papal charges a minimum fee of USD 0.25 and a maximum fee of USD 25.00 per transaction.

Use Case

PayPal is suitable for quick, small payments, particularly when you need immediate transactions.

Payment Method 4: Direct Bank Transfer

Direct bank transfers are a traditional method of payment. They are suitable for businesses that operate within a country and transfer payments directly via banks. Transaction fees vary among banks, some charge as low as $1 while others charge up to $20 per transaction.

Paying Virtual Assistants via Direct Bank Transfer

Key Benefits:

- Reliability: Bank transfers are generally secure and reliable.

- No Third-Party Fees: This method often eliminates third-party fees, resulting in cost savings.

- Ease with Local Payments: Direct bank transfers work particularly well for domestic payments.

Note: However, direct bank transfers can have longer processing times and may complicate international payments. Banks often demand payment proofs and invoices for international payments.

Use Case

This method is best for paying people in the same country, where quick and straightforward transactions are necessary. In short, it’s not suitable for you if your VAs are from other countries.

Wise vs Payoneer vs PayPal vs Direct Bank Transfers—Which One is Best to Pay Your VA

| Payment Methods | Transaction Fees | Speed | International Availability |

| Wise | Low | Fast | High |

| Payoneer | Moderate | Moderate | High |

| PayPal | High | Instant | High |

| Direct Bank Transfer | Very High for International Payments | Slow | Low |

In context to the above data, Wise is the cheapest way to pay an international VA as compared to Payoneer, Papal, and Direct Bank Transfers.

Pay Your VA with WorkStaff360’s Diverse Payment Methods

WorkStaff360 is a Virtual Staffing Company that provides pre-trained VAs and manages their onboarding and payment processes for your business so that you do not have to.

At WorkStaff360, we understand that delayed payments are frustrating. Your business needs a fast payment service to keep the ball rolling. We help you process your transactions all over the world so that you can focus on growing your business.

From Wise and Payoneer to PayPal and direct bank transfers, we provide flexible, secure, and cost-effective solutions for smooth transactions. Book a call with our dedicated teams to find out more.